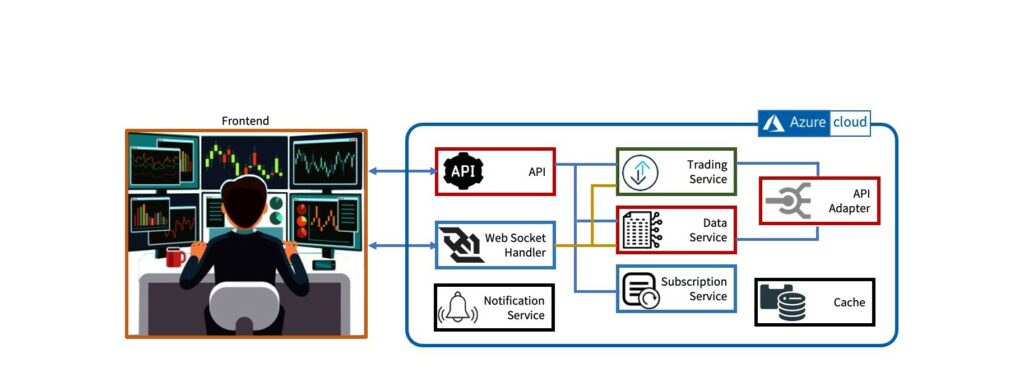

The customer had an existing trading platform with a backend integrated with multiple financial institutions/ exchanges. The system used to get sluggish when users and data points soared. Also, the user interface design didn’t scale up to help decide complex trading strategies as expected by Hedge fund managers. The customer wanted to fix these issues avoiding changes in the backend integration before adding new features.

Trenser engaged as an offshore development partner in T&M mode. Trenser team worked closely with the customer engineering team to understand the current performance problems and create a new architecture to solve the issues. After completing the performance enhancements, the Trenser team engaged for feature additions and maintenance.